Long-term, Off-Balance Sheet, Non-Recourse Loans for development of Large Commercial/Industrial Solar Power Projects secured by the assets and operations of the project.

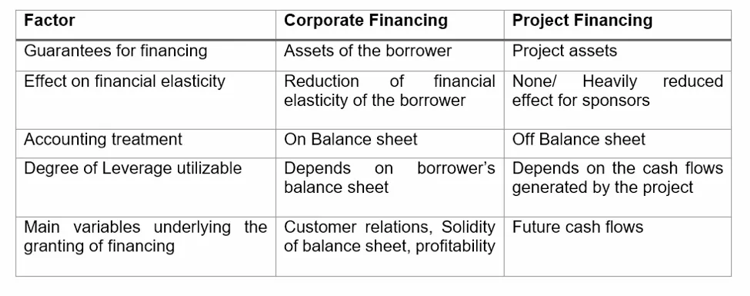

Comparation between Corporate Finance and Project Finance

Solar Project Finance allows businesses to generate solar electricity with little upfront capital investment. You benefit from the clean electricity generated from the Solar Power Project. After completion of the loan period customer gets huge savings compared to RESCO Model.

We are strategically tied up with some National Level Financial Firms for financing of your solar power project. They provides financing solution on attractive rates and affordable terms.

Benefits of Solar Project Financing

- Domestic & Small Project Finance from Nationalized Bank @ very competitive and attractive rate of interest.

- Large MW Scale Project Finance from Overseas Financial Institutes / Banks, JV & Equity Partnership

- Margin as low as start from 11% of the project cost.

Key Considerations

- Whether you want to work with our preferred financial institution or you want to explore alternatives, we can help you with the project report and other compliances for the loan documentations.

- We have experience how to accurately forecast energy output, secure favorable terms and streamline the negotiation process to help you minimize your financial commitment while maximizing the return on your solar investment.

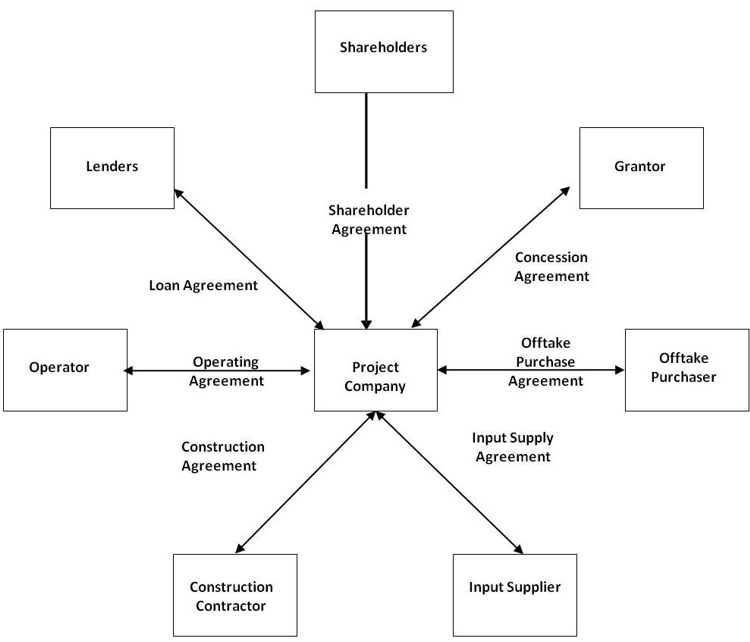

The typical project financing structure, which has been simplified for these purposes, for a Build, Operate and Transfer (BOT) project is shown. The key elements of the structure are:

- Special Purpose Entity (SPE) project company with no previous business or record;

- Sole activity of project company is to carry out the project – it then subcontracts most aspects through construction contract and operations contract;

- For new build projects, there is no revenue stream during the construction phase and so debt service will only be possible once the project is online during the operations phase, thus there are significant risks during the construction phase;

- Sole revenue stream likely to be under an off-take or power purchase agreement;

- Project finance loans are non-recourse as to the borrowers, including the sponsors of the project and shareholders of the project company. There are extensive project financing documents that required no personal liability under the project loans. Thus, the project sponsor and project shareholders are liable only up to the extent of their shareholdings;

- Project Finance Structure means the project remains off-balance sheet for the sponsors and for the host government.

Delivering Finance Solution for Solar Power Project. EREPL arranging international financier inexorably committed to making its every client deal more profitable while at the same time aggressively protecting their interests through superior deal structuring.

The strength of our core disciplines is superior advisory services, which we apply in every deal, even before discussing financing options. We engage our world-class advisory and underwriting expertise to develop the optimal deal structure while providing enhanced due diligence and anti-money laundering advisory in addition to deal structuring.

With deal structure settled and in hand, we aggressively pursue the best financing options in capital markets worldwide. Whether providing trade financing, project financing or contract financing, when we combine deal structure, enhanced due diligence and best in class financing we deliver financing solutions that are consistently among the best in the world.

Another of our core strengths is the ability to successfully provide Solar Project Financing to customers who have previously been rejected by banks and other financiers. In fact, we have been extremely successful at financing deals for clients who were rejected elsewhere before coming to us.

The global shortage of solar project finance has made this phenomenon increasingly common, especially for small projects. Years of underwriting experience coupled with powerful strategic partners position us to successfully finance deals where others have come up short. If you have been rejected by other lenders or financiers we can help, request financing today.

Project Finance provides long-term, limited recourse or non-recourse loans used to finance large commercial or industrial Solar Power Projects.

Unique to project financing is the debt and repayment structure are based on the projected cash flow of the project rather than the balance sheets of the project sponsor. Usually, a project finance structure involves a number of equity participants, who can be project sponsors or equity investors, and a consortium of lenders that provide loans to the project.

Project finance loans are almost always extended on a non-recourse or limited recourse basis and are secured by the project assets and operations. Repayment of the loans occurs entirely from project cash flow, not from the assets or credit of the borrower.

Underwriting for project development loans focuses on what is usually a business plan that includes extensive financial modeling and sensitivity analysis. The financing is typically secured by all of the project assets, including the revenue-generating components of the project. Lenders are granted a lien on all of the project assets and are further granted the right to assume managerial and operational control of a project, along with the mechanism to do so if the project doesn’t comply with the loan terms.

The borrower is typically a Special Purpose Entity or SPE which is created in the project finance documents specifically to own the project. The SPE ownership structure coupled with non-recourse debt effectively shields the assets of both the project sponsor and equity investors from collection efforts or deficiency actions if the project fails.

With collection actions barred if the deal fails, project lenders often require a commitment from the project owners to contribute capital to the project to ensure the project is sufficiently capitalized and financially sound, and also to demonstrate the project sponsors’ commitment to the deal.

Allocation of the risk stack among project participants is a key component of project finance. Project developments are often subject to technical, environmental, economic and political risks, particularly in developing countries and frontier and emerging markets. If the lenders or project sponsors determine that the risk exposure is too great during underwriting, the project is rendered unfinanceable.

Long-term contracts for construction, supply, off-take, operations and concessions, along with contracts establishing joint-ownership of the project are structured in extensive project documentation to best align the interests and incentives of all the project participants. They are also designed to dissuade bad behavior on the part of the deal participants. In this way, project risk is allocated amongst the deal participants who are best able to manage the risk.

The amounts involved in project development financing are often so vast that no single lender could or should provide the entirety of the project financing. Instead, the project financing is often syndicated to a consortium of lenders to distribute the risk.

Project financing was used as far back as the ancient Greeks and Romans to finance maritime voyages. It was project finance that funded construction of the Panama Canal and the North Sea oil wells.

Today, most project financing is deployed in developing countries around the world where the need for project financing remains high and will for the foreseeable future. As more countries move from frontier to emerging economies demand for public utilities and infrastructure will continue to increase.

Project sponsors who are seeking equity investors, project lenders and other stakeholders have to appeal to these potential project participants by presenting them with a proposal that is sufficiently compelling to get them to risk vast sums of money investing in their project. In other words, project sponsors must demonstrate that an investment in their project will provide a return on their invested capital that is great enough to put their money at risk.

Most proposed investments involve the acquisition of an asset that is already in operation and already has demonstrable revenue, such as a company, an apartment community or an industrial facility. Project financings don’t have operating assets with demonstrable because they involve the development of assets. With unproven revenue, expenses and cash flow, project sponsors must base their proposals to potential equity investors and lenders on projections. They do that with financial models and well-written, compelling business plans.

Project financial models are sophisticated computer spreadsheets that employ a lengthy list of business assumptions and variables to develop financial forecasts of capital costs, revenues, expenses, cash flow and future value of the assets. Financial models are tools used by project sponsors to negotiate with investors and lenders, and as support for appraisals and financial feasibility studies.

Because financial models form virtually the entire basis for investing in or lending on the proposed project, they must be based on reasonable, believable and transparent assumptions and variables that reflect the anticipated real-life interaction between data and calculated values. Financial models must be capable of sensitivity analysis that calculate projections based on a range of data variations. They must also demonstrate future profits and returns on investment which are sufficiently compelling to convince investors and lenders to invest in your project.

- Company Documents (MCA/ROC), along with KYC of All Directors/Partners

- Share Holders List with % of holding

- Detail Project Report

- Connectivity / Permission Letter

- Power Purchase Agreement / Proposed Power Purchase Customer

- Power Purchasing Company Details and its last one year Electricity Consumptions records

- Land / Proposed Land Documents

- EPC Contract

- O&M Agreement

- Intercreditor Agreement

- Tripartite Deed

- Minimum Common Terms

- Concession Deeds

After scrutiny of above documents, if any additional informaiton or documents, required, we will inform.